unrealized capital gains tax janet

Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Janet Yellen Discusses Unrealized Capital Gains Tax Proposal House Speaker Pelosi Approves.

. Secretary of the treasury Janet Yellen discussed the subject on CNNs State of the Union Yellen explained the concept which aims to tax. 24 2021 126 pm ET. Bidens newly appointed US.

By Kristina Peterson and Richard Rubin. Capital gains tax is a. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains.

Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could hurt. 24 2021 125 pm ET. Ron Wydens plan to tax unrealized capital gains of billionaires is something else.

According to Yellen the funds collected would help finance things. Government coffers during a virtual conference hosted by The New York Times. An Act of War Against the Middle-Class Americans Criticize Janet Yellens Idea to Tax Unrealized Capital Gains The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Capital gains rates are usually lower than ordinary income tax rates so having an understanding of the opportunity within your portfolio can help with tax planning investment strategy and more. The plan will be included in the Democrats US 2 trillion reconciliation bill. Knowing the distinction between unrealized gains versus capital gains can be helpful when looking at what kind of investments might work best for.

As Cathie Wood states it is the worst proposal of all when it comes to stock. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

Secretary of the. Treasury Secretary Janet Yellens proposal backed by Democrats in the House of Representatives to include a tax on unrealized capital gains in President Joe Bidens spending plan has caused quite a stir. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Janet Yellen doesnt care. Lawmakers are considering taxing unrealized capital gains.

An UNREALIZED GAIN is one in which the underlying asset is not sold but simply valued comparing the price from last year to the price this year even though you have not sold the asset and actually generated income. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens now. Capital gains tax is a tax on the profit that investors realize on the sale.

President Biden Unveils Unrealized Capital Gains Tax for Billionaires Posted on 10252021 As US. Janet Yellen Capital Gains Tax - YouTube An unrealized capital gains tax would change the stock market forever. 24 2021 626 pm ET Original Oct.

It is this unrealized capital gain that the administration proposes to tax not when sold but when valued. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2. A capital gain is the profit you make when you sell an investment asset for.

According to Yellen the funds collected would help finance things related to. The tax targets unrealized capital gains which are oxymorons that exist only in the minds of tax law enthusiasts. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

WASHINGTONA new annual tax on billionaires unrealized capital gains is likely to be included to help pay for the vast social. The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. The Biden Administration is pretending that Oregon Sen.

Capital gains tax is a. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Lawmakers are considering taxing unrealized capital gains.

Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain. Yellen Describes How Proposed Billionaire Tax Would Work. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Treasury Secretary Janet Yellen is currently considering some shocking policies.

Us Government Unrealized Gains Tax Plans Might Hit Crypto 039 Billionaires 039 Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

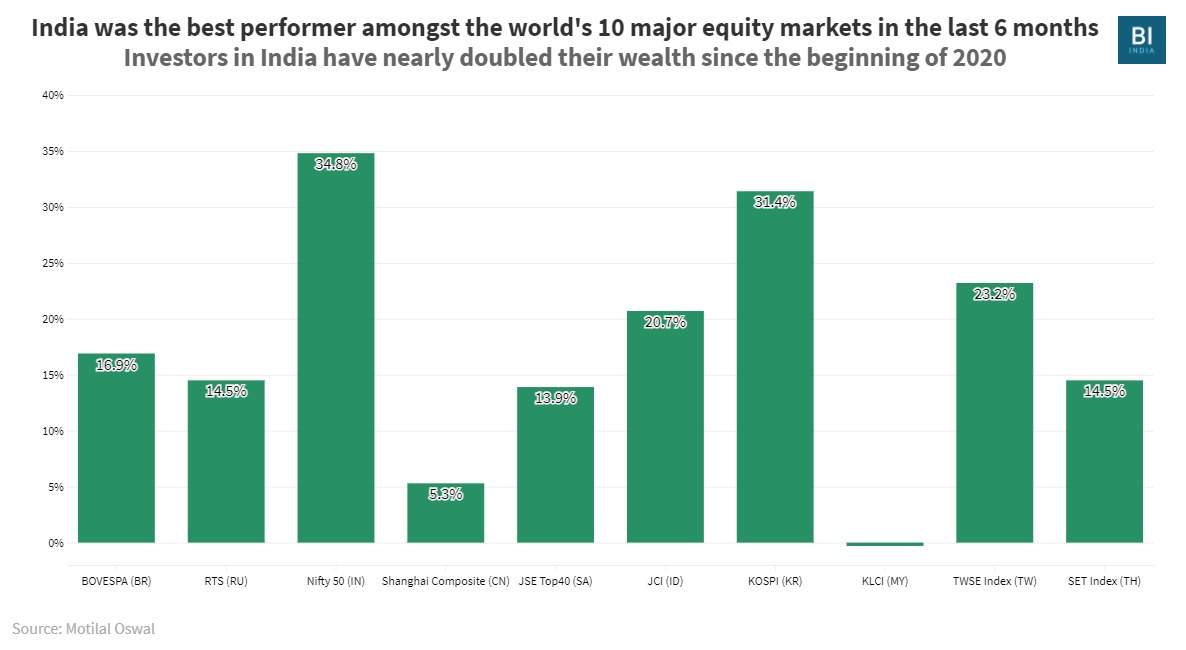

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Instagram Economics Idiots Rich People

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Busines Capital Gains Tax Capital Gain What Is Capital

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets